Software as a Service (SaaS) is not a simple subject. Like any other industry, the world of SaaS has developed its jargon over the years.

It is the responsibility of any product manager, founder, CEO, etc. to familiarize themselves with the latest technical and business terminologies of the industry.

Understanding these technical terms and metrics is key to optimizing your SaaS business. The knowledge of certain terminologies will open your eyes to specific problems that need your attention. For example, understanding the meaning of customer churn will stimulate you to formulate strategies to combat it.

Scaling a software platform is a high stake high reward business. You cannot afford ignorance. Getting to know the technical terms in retention may save your business a lot of money.

To make it easier for you to build a strong SaaS foundation, here are ten must-know terms in SaaS Retention:

1. Cohort Analysis

Contrary to popular belief, Cohort Analysis is not a specific churn metric. Instead, Cohort Analysis is the measurement of the net or gross churn of a particular group of customers (cohort) over time. In most cases, we define cohorts by the acquisition date of the customer. For example, a client can be a “January 2020” cohort of customers, or a “May 2020” cohort, etc.

As a company, you can compare the attrition rates of different cohorts at their respective six, twelve, or eighteen-month intervals. Cohort Analysis provides insight into customer success and onboarding programs. The metric can also help your company to understand if it is trending towards acquiring clients who are more (or less) likely to churn. You can further refine cohorts based on customer type or size. The refinement adds clarity to the fundamental churn characteristics of a specific cohort.

For a more in-depth discussion on churn, check out the resources below:

2. Customer Churn Rate

The customer churn rate is the most well-known matrics of churn. Customer churn rate is the percentage of clients who leave your company over a given time frame. You can calculate the customer churn rate by dividing the number of churned customers by the total number of customers in the common period. Multiply the variable by 100 to get the percentage.

Churned customers are consumers that have left your company or discontinued your services.

For Example:

You have 100 customers at the start of July. By the end of the month, five customers cancel your services. In July, your churn rate is 0.05 or 5%. How? Divide five customers by a hundred to get 0.05. For the percentage, multiply 0.05 to get 5%.

A 5% customer churn rate may not be sustainable in the long run, but for a startup, it is fixable.

Customer churn rate is the only metric that a startup needs to address retention at the company’s infancy. Grasping customer churn rates helps you get to other essential parameters for your business. You can use this churn rate to calculate the average customer lifetime.

3. Revenue Churn Rate

Revenue churn is the percentage of recurring revenue lost from cancelation over a specific period (month, year, etc.). You can calculate the revenue churn rate by dividing your churned monthly recurring revenue (MRR) by the total monthly recurring revenue. As for the percentage, multiply your result by 100.

For companies that charge their services per user or employ a pricing tier model, the revenue churn rate put a dollar amount on what customer churn costs your business at what speed. Revenue churn is entirely different from customer churn. Revenue churn will paint you a different picture.

For example:

You have a 5% customer churn rate from our previous example. All five customers were big enterprise companies that subscribed to your premium services. Out of a total monthly recurring revenue (MRR) of $50,000, the churned customers accounted for $10,000. The revenue churn rate, in this case, is 20%.

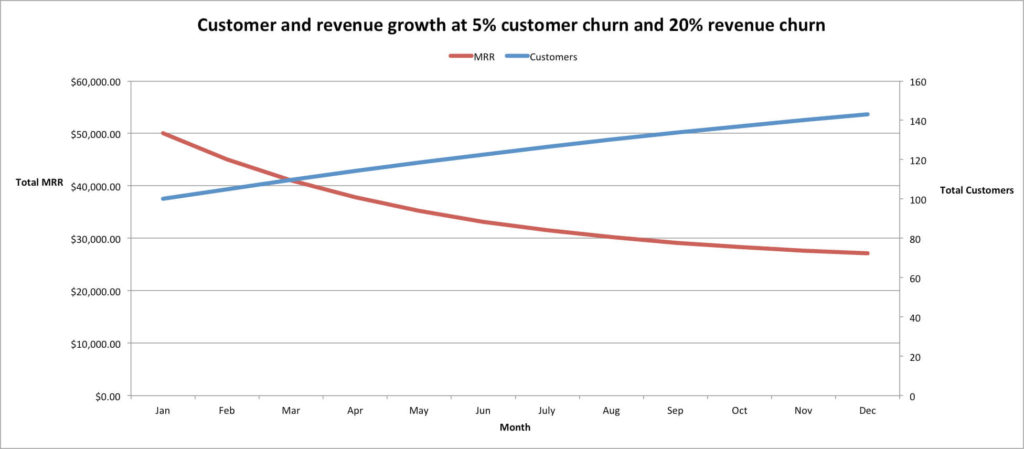

If you only concentrated on customer churn rates, you would be unable to grasp the retention issues occurring under the surface. Check out from the graph below to appreciate what is happening underneath your otherwise successful business. We will assume that you acquired ten new clients and $5,000 in MRR per month.

You may be bringing in new customers, but the revenue they bring is insignificant to the revenue churn.

4. Net Negative Churn

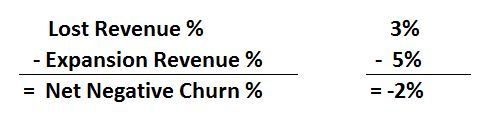

Net negative churn occurs when the expansion revenue from your existing customers exceeds lost revenue from the existing customers. Net negative churn does factor in revenue from new customers. Instead, it focuses on existing customers.

To calculate the net negative churn, find the difference between the lost revenue and the expansion revenue. Expansion revenue includes add-ons and upsells from existing customers. Lost revenue includes downgrades and/or lost customer revenue.

The example above is in percentages. However, you can calculate net negative churn in dollars.

5. Monthly Recurring Revenue (MRR)

Monthly recurring revenue or MRR is the sum of your subscription revenue represented as a monthly value. MRR is the sum of all expansions or new subscriptions and upgrades, minus downgrades (contractions), and discontinued subscriptions.

For Example:

If ten customers are paying $150 per month, the MRR would be $1,500. If seven customers are paying $200 per month, and three customers are paying $100 per month, then the MRR would be $1,700.

MRR is not an accepted GAAP value, but it’s the revenue equivalent. It is employed by almost every SaaS company.

6. Annual Recurring Revenue (ARR)

The annual recurring revenue (ARR) is the sum of all subscriptions represented as a yearly figure. The calculation of ARR is similar to that of MRR Except on an annual basis. It is the total expansions minus contractions and discontinued subscriptions. ARR is not an accepted GAAP metric. However, it’s the revenue equivalent that is employed by all SaaS companies.

7. Net Revenue Retention

Net revenue retention measures the total change in the recurring revenue of a group of customers over time. To calculate net revenue retention, divide the current MRR by the company’s MRR one year ago.

This metric captures the negative impact of losing customers. It also captures the positive impact of cross-selling, price changes, up-sells, and growth in usage or seats.

8. Gross Revenue Retention

Gross revenue retention removes the impact of up-selling, cross-selling, price increases, and organic customer growth within an installed customer base. It is an excellent indicator of how your company is doing in terms of retaining revenue over time. Gross revenue retention can never be greater than 100%. It can be equal to or less than 100%.

The basic calculation of MRR is similar to that of net revenue retention. However, the MRR of each customer in the current month never exceeds the MRR of that client in a year.

9. Cost of Acquiring a Customer (CAC)

CAC is a measurement that captures the amount that you spend on sales and marketing campaigns to get a new customer. You can calculate CAS by adding up the total cost of sales and marketing (salaries included) in a given month and dividing the sum bu the number of new customers acquired in that month.

CAC relates to another SaaS metric, the Lifetime Value of a customer (LTV). A business is viable when you make more money from a customer that it cost you to acquire the client.

Refer to the illustration below:

LTV needs to be greater than CAC. An excellent rule of thumb is that LVT should be at least three times the value of CAC.

10. Customer Lifetime Value (CLV or LTV)

LVT is the total revenue generated by a specific customer throughout your relationship. The longer a customer continues to transact with you, the higher their LVT.

To calculate LVT, subtract CAC from the product of a customer’s revenue and the customer’s lifetime.

Using SaaS Metrics to Make Better Decisions

Now that you understand the essential SaaS metrics, what do you do with them? Collecting data is helpful when you use the data to inform your decisions. The information that you obtain from these parameters will help you streamline your business for success.

Written by: Tony Zayas, Chief Revenue Officer

In my role as Chief Revenue Officer at Insivia, I am at the forefront of driving transformation and results for SaaS and technology companies. I lead strategic marketing and business development initiatives, helping businesses overcome plateaus and achieve significant growth. My journey has led me to collaborate with leading businesses and apply my knowledge to revolutionize industries.